Advertisement

2023 GOVERNORSHIP AND

STATE HOUSE OF ASSEMBLY ELECTIONS

- days

- Hours

- Minutes

- Seconds

Advertisement

The Central Bank of Nigeria (CBN) and the Asset Management Company of Nigeria (AMCON) on Thursday confirmed the sales of Polaris Bank.

This followed the completion of a Share Purchase Agreement (SPA) for the acquisition of a 100 percent stake in Polaris Bank by Strategic Capital Investment Limited (‘SCIL’).

The House of Representatives had on Wednesday okayed the sale of the bank, noting that the acquisition followed the laid down procedure and the relevant presidential approval.

The Chairman of the House ad-hoc Committee investigating the sale of Polaris Bank, Henry Nwabuba, told journalists that 35 companies bided for the bank.

Nwabuba’s revelation came a few days after Nigerians criticised the CBN for planning to sell Polaris Bank for N50 billion.

Advertisement

The amount raised eyebrows given that over N1.2 trillion have been spent by AMCON to revive the bank.

In a statement issued by its Director of Corporate Communications, Osita Nwanisobi, the CBN said that SCIL has paid upfront of N50 billion to acquire a 100 percent stake in Polaris Bank

The apex bank added that SCIL accepted the terms of the agreement, including the full repayment of the sum of N1.305 trillion as the value of the bonds when the licence of the former Skye Bank Plc was revoked in 2018 to assume its assets and certain liabilities.

The statement read: “The Central Bank of Nigeria (CBN) and the Asset Management Company of Nigeria (AMCON) are pleased to announce the completion of a Share Purchase Agreement (SPA) for the acquisition of 100% of the equity in Polaris Bank by Strategic Capital Investment Limited (‘SCIL’).

“Polaris has been operating as a bridge bank since 2018 when the Central Bank of Nigeria intervened to revoke the licence of the former Skye Bank Plc. and established Polaris Bank to assume its assets and certain liabilities. As part of the CBN intervention, consideration bonds with a face value of N898 billion (future value of N1.305 trillion) was injected into the bridge bank through AMCON, to be repaid over a 25-year period.

“These actions were taken to prevent the imminent collapse of the bank, enable its stabilisation and recovery, protect depositors’ fund, prevent job losses and preserve systemic financial stability. SCIL has paid an upfront consideration of N50 billion to acquire 100% of the equity of Polaris Bank and has accepted the terms of the agreement which include the full repayment of the sum of N1.305 trillion, being the consideration bonds injected.

“The CBN thus received an immediate return for the value it has created in Polaris Bank during the stabilisation period, as well as ensuring that all funds originally provided to support the intervention are recovered. The sale was coordinated by a Divestment Committee comprising representatives of the CBN and AMCON, and advised by legal and financial consultants. The Committee conducted a sale process by ‘private treaty, as provided in Section 34(5) of the AMCON Act to avoid negative speculations, retain value and preserve financial system stability.”

(Ripples)

Disclaimer

Contents provided and/or opinions expressed here do not reflect the opinions of The Pacesetter Frontier Magazine or any employee thereof.

Support The Pacesetter Frontier Magazine

It takes a lot to get credible, true and reliable stories.

As a privately owned media outfit, we believe in setting the pace and leaving strides in time.

If you like what we do, you can donate a token to us here. Your support will ensure that the right news is put out there at all times, reaching an unlimited number of persons at no cost to them.

Related posts

Stay connected

Recent News

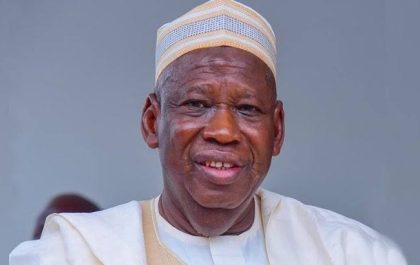

Kano Judge Vacates Order Suspending Ganduje as APC Nat’l Chairman

Advertisement A Kano State High Court presided over by Justice Usman Na’Abba has vacated the order suspending ex-Kano governor Umar…

IGP Egbetokun kicks against state-controlled police, says Nigeria not yet ripe for it

Advertisement The Inspector General of Police, Olukayode Egbetokun, has opposed the establishment of State Police, saying the country was not…