Advertisement

2023 GOVERNORSHIP AND

STATE HOUSE OF ASSEMBLY ELECTIONS

- days

- Hours

- Minutes

- Seconds

Advertisement

Governor, Central Bank of Nigeria, Mr. Godwin Emefiele yesterday called on banks and stakeholders in the financial sector to come up with actionable plans to boost foreign exchange inflow from non-oil exports.

Emefiele made this call in his opening remarks at the 13th annual Bankers Committee retreat held in Lagos with the theme, “Increasing the Productive Base of the Nigerian Economy and Non-Oil Export Revenues,”

Emefiele stressed that the nation needs actionable plans to boost non-oil revenue given the sharp decline in forex inflow from oil exports triggered by various factors bedevilling the global economy

Consequently, Emefiele challenged the gathering of bank executives on the need to come up with measures to resolve structural issues inhibiting Nigeria’s non-oil export receipts as well as strengthen the immunity and engender the resilience of the economy against exogenous shocks.

He said, “We must, in an attempt to walk towards diversifying the nation’s economy, think about how we can be less reliant on crude revenues. We are in the business of servicing our customers and servicing customers also entails that they have import needs and they need foreign exchange to conduct their import activities.

Advertisement

“To do so means you need foreign exchange for solving them. There is a clear shortage of foreign exchange today but yet as bankers, we must meet the needs of our customers. The market is tight and I know we don’t have a choice, we will have to do something to ensure that this problem is solved.

“That is the reason we decided at this retreat to focus on RT200 because essentially, we have to think about how to source foreign exchange for our customer’s needs without necessarily needing to resort to revenues from crude which as we all know has come to zero or almost zero compared to about $3 billion monthly that we were getting in 2014″

Speaking further, the CBN Governor said: “This retreat is convened to focus on the development of the local manufacturing industry and non-oil sectors, more broadly, and particularly to enhance the sector’s capacity to generate foreign exchange inflows. The focus is even more germane considering the enormity of the global economic turbulence, as wave after wave of negative shocks continue to ravage many countries.

“The Bankers’ Committee must recognise the critical role of the financial system in accelerating the development of the productive base of the economy. We must play our productive parts to engender the necessary infrastructure and services that are critical to boos non-oil exports.

“The 2022 Bankers’ Committee Retreat provides us with the opportunity to review the progress and impact of implementation of RT200. It is equally an occasion to re-examine our support for other government programmes to promote non-oil export and to identify specific implementable actions by the financial system to enhance foreign exchange revenues.

“At this retreat, we must come up with actionable steps to ensure that the Bankers’ Committee continues to make meaningful contributions to the growth and development of our dear country.”

(Vanguard)

Disclaimer

Contents provided and/or opinions expressed here do not reflect the opinions of The Pacesetter Frontier Magazine or any employee thereof.

Support The Pacesetter Frontier Magazine

It takes a lot to get credible, true and reliable stories.

As a privately owned media outfit, we believe in setting the pace and leaving strides in time.

If you like what we do, you can donate a token to us here. Your support will ensure that the right news is put out there at all times, reaching an unlimited number of persons at no cost to them.

Related posts

Stay connected

Recent News

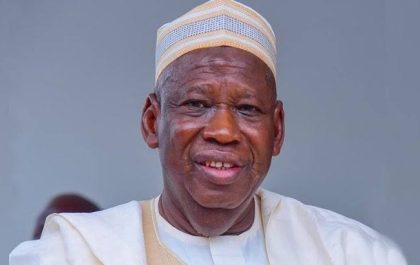

Kano Judge Vacates Order Suspending Ganduje as APC Nat’l Chairman

Advertisement A Kano State High Court presided over by Justice Usman Na’Abba has vacated the order suspending ex-Kano governor Umar…

IGP Egbetokun kicks against state-controlled police, says Nigeria not yet ripe for it

Advertisement The Inspector General of Police, Olukayode Egbetokun, has opposed the establishment of State Police, saying the country was not…