Advertisement

2023 GOVERNORSHIP AND

STATE HOUSE OF ASSEMBLY ELECTIONS

- days

- Hours

- Minutes

- Seconds

Advertisement

The Central Bank of Nigeria (CBN) has said it ordered 500 million pieces of the redesigned naira notes introduced recently.

Its governor, Godwin Emefiele, stated this yesterday, when he briefed the House of Representatives on the new cash withdrawal limit introduced by the apex.

The CBN boss, in reaction to a question on the quantity of the redesigned N1000, N500 and N200 notes printed, especially as the new notes are being rationed in commercial banks, said: “We ordered 500 million pieces of currency from the mint. That is what has been ordered.”

Emefiele, who was represented by the CBN deputy governor, in charge of Financial System Stability, Aisha Ahmad, said the new cash withdrawal limit was not politically motivated.

The House had two weeks ago summoned the CBN boss to appear before it after lawmakers kicked against the policy saying it was inimical to country’s economy.

Advertisement

Emefiele after failing to appear before the House twice for varied reasons, delegated Ahmad to represent him, yesterday.

The deputy governor explained that the new cash withdrawal limit was a continuation of the cashless policy, which kicked off in 2012.

Ahmad, in response to conspiracy theory by some lawmakers that the cash withdrawal limit is a ploy to weaken opposition parties, ahead of the 2023 polls, noted that the polices of the apex bank were not politically motivated.

“We have to make it very clear that the CBN is an independent institution. Our decisions are taken based on research, data and it is the work of many teams working together across the different directorates. At no time do we make decisions based on any political consideration and I think it’s important that I state that.

“Our policy pronouncement on December 5 was a continuation of the cashless policy that we started 10 years ago and it was in recognition of the positive changes that have happened in the financial and payment system since the cashless policy was first launched.”

She noted that though there might be some challenges associated with the policy, the benefits far outweigh the challenges, adding that the benefits include a reduction in cash processing cost, minting, costs of destroying old notes and moving cash around.

“Also, this is an opportunity to promote Nigeria’s positive image from money laundering perspective. Even the recently passed Anti-Money Laundering Law has limits for cash for a reason because cash is usually the medium by which some of these nefarious activities are done.”

He further explained that “the data available to us shows that 94 percent of all cash transactions falls below the N500,000 limit and this includes in areas in the country that are not part of the cashless policy. Eighty two percent of corporate transactions also are below this limit.

“What does this mean? It means that 94 percent of all individual transactions will not be affected by this fees that we have talked about. I have seen some misconceptions about the fees that we are charging the fees on the entire amount that wants to be withdrawn.

“The fees are to be charged on any withdrawal above the limit. For example, if you are withdrawing N550,000, the fee will be on the N50,000. We also looked at transactions for agents. So, transactions by Nigerians that go to the agent’s location and transactions by the agent’s themselves, the average cash transactions of agents is N2,184,000 which is clearly within the current limit.

“The average transaction per individual that walks up to an agent is about N18,000. What the policy is trying to do is to encourage more people to come into the formal payment system because of the numerous benefits that accrue.”

She said the policy was expected to create new jobs in the ICT sector, contrary to insinuations that it would lead to job lost.

She said operators of Point on Sales (POS) would not be affected by the policy, adding that CBN was aware POS had created a means of livelihood for about 4.4 million.

The speaker, Femi Gbajabiamila, said the House would meet and deliberate on the brief by the CBN boss. “Reason the House needed to be briefed under the contemplation of the law was because this House represents the people out there. So, by briefing the House, we can now go back, assuming we agree with your policy to our constituents and let them know what is going on and why it is going on.”

(Sun)

Disclaimer

Contents provided and/or opinions expressed here do not reflect the opinions of The Pacesetter Frontier Magazine or any employee thereof.

Support The Pacesetter Frontier Magazine

It takes a lot to get credible, true and reliable stories.

As a privately owned media outfit, we believe in setting the pace and leaving strides in time.

If you like what we do, you can donate a token to us here. Your support will ensure that the right news is put out there at all times, reaching an unlimited number of persons at no cost to them.

Related posts

Stay connected

Recent News

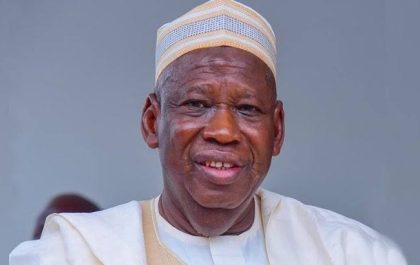

Kano Judge Vacates Order Suspending Ganduje as APC Nat’l Chairman

Advertisement A Kano State High Court presided over by Justice Usman Na’Abba has vacated the order suspending ex-Kano governor Umar…

IGP Egbetokun kicks against state-controlled police, says Nigeria not yet ripe for it

Advertisement The Inspector General of Police, Olukayode Egbetokun, has opposed the establishment of State Police, saying the country was not…