Advertisement

2023 GOVERNORSHIP AND

STATE HOUSE OF ASSEMBLY ELECTIONS

- days

- Hours

- Minutes

- Seconds

Advertisement

The Federation Account Allocation Committee (FAAC) has shared a total sum of N966.110 billion July 2023 revenue to the federation account among the three tiers of government.

The N966.110 billion total distributable revenue comprised distributable statutory revenue of N397.419 billion, distributable Value Added Tax (VAT) revenue of N271.947 billion, electronic money transfer levy revenue of N12.840 billion and exchange difference revenue of N283.904 billion.

According to a statement that was issued by the director of information in the Office of Accountant-general of the Federation Bawa Mokwa, the meeting was chaired by the minister of finance and coordinating minister of the economy, Wale Edun.

In July 2023, the total deductions for cost of collection were N62.419 billion and total deductions for savings, transfers, refunds and tax credit cancellation was N717.962 billion.

The balance in the Excess Crude Account (ECA) was $473,754.57.

Advertisement

The communiqué stated that from the total distributable revenue of N966.110 billion; the federal government received N374.485 billion, the state governments received N310.670 billion and the local government area received N229.409 billion. A total sum of N51.545 billion was shared to the relevant States as 13 per cent derivation revenue.

Gross statutory revenue of N1.150 trillion was received for the month of July 2023. This was lower than the sum of N1.152 trillion received in the month of June 2023 by N2.497 billion.

From the N397.419 billion distributable statutory revenue, the federal government received N190.489 billion, the state governments received N96.619 billion and the LGAs received N74.489 billion. The sum of N35.822 billion was shared to the relevant States as 13 per cent derivation revenue.

For the month of July 2023, the gross revenue available from the VAT was N298.789 billion. This was higher than the N293.411 billion available in the month of June 2023 by N5.378 billion.

The federal government received N40.792 billion, the 36 state and Federal Capital Territory received N135.974 billion and the local governments received N95.181 billion from the N271.947 billion distributable Value Added Tax (VAT) revenue.

The N12.840 billion electronic money transfer was shared as follows: the federal government received N1.926 billion, states and FCT received N6.420 billion, while LGAs received N4.494 billion.

From the N283.904 billion exchange difference revenue, the federal government received N141.278 billion, subnational governments received N71.658 billion, the LGAs received N55.245 billion and the sum of N15.723 billion was shared to the relevant states as 13 per cent mineral revenue.

Leadership

Disclaimer

Contents provided and/or opinions expressed here do not reflect the opinions of The Pacesetter Frontier Magazine or any employee thereof.

Support The Pacesetter Frontier Magazine

It takes a lot to get credible, true and reliable stories.

As a privately owned media outfit, we believe in setting the pace and leaving strides in time.

If you like what we do, you can donate a token to us here. Your support will ensure that the right news is put out there at all times, reaching an unlimited number of persons at no cost to them.

Related posts

Stay connected

Recent News

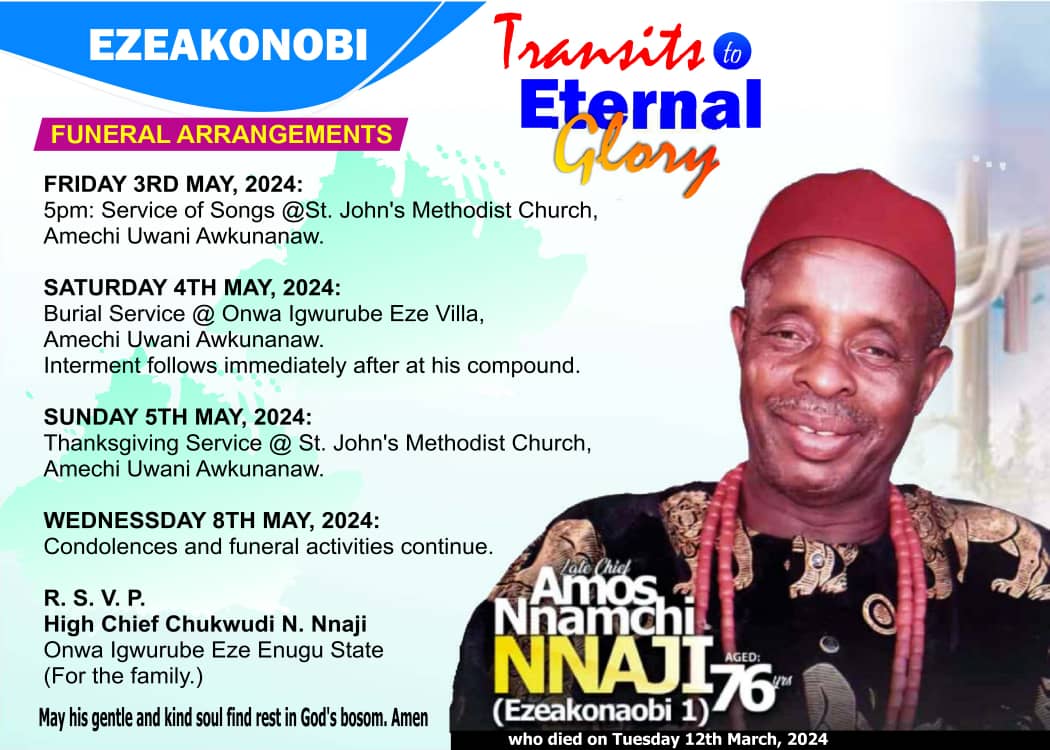

JUST-IN: 9th Holdings CEO, Chukwudi Nnaji, Buries Father May 4

Advertisement Chetanne Chinelo, Enugu The family of Nnaji Nwaga Nnaji of Amechi Uwani, in Enugu South Local Government Area of…

Lone Fatal Motor Accident Claims Lives of 16 Travelers on Enugu Road

Advertisement …CP Kanayo visits the scene and describes the accident as sad …commiserates and enjoins individuals with information to trace…