Advertisement

2023 GOVERNORSHIP AND

STATE HOUSE OF ASSEMBLY ELECTIONS

- days

- Hours

- Minutes

- Seconds

Advertisement

With plans by the Central Bank of Nigeria (CBN) to introduce a new capital base for deposit money banks in Nigeria, economists have cautioned the apex bank from making some mistakes made during the last recapitalisation of commercial banks in the country.

The Founder of Centre for Promotion of Private Enterprise, Muda Yusuf; and Prof Segun Ajibola of Babcock University, Ogun State, both spoke on Channels Television’s Sunrise Daily programme on Monday.

The economists agreed that recapitalisation of banks has become inevitable but it must be done in such a way that the mergers and acquisitions that would hit banks won’t lead to massive job cuts.

“What we had in 2005 was very unfortunate. Banks should not be stampeded,” Yusuf said, urging the CBN to give banks enough time for systemic migration.

He suggested a year or two for the process and not for the apex bank to insist on a short deadline like what was done during the era of ex-President Olusegun Obasanjo.

Advertisement

On his part, Ajibola called for strategic consultations between stakeholders for the process to be fluid and successful, saying that the CBN should not force banks into unholy alliances.

Last Friday, CBN chief, Yemi Cardoso said Nigerian banks do not have sufficient capital relative to the finance system needs in servicing a $1trn economy.

“As a first step, the Central Bank will be directing banks to increase their capital,” he announced at the 60th anniversary of the Chartered Institute of Bankers of Nigeria (CIBN) in Lagos State.

The last time the CBN increased capital base for banks was in 2005 when current Anambra State Governor, Charles Soludo, was the apex bank chief. Capital base was raised from N2bn to N25bn, with more than 80 banks collapsing into about 30 in an unprecedented season of mergers and acquisitions that came with attendant job losses.

Channels TV

Disclaimer

Contents provided and/or opinions expressed here do not reflect the opinions of The Pacesetter Frontier Magazine or any employee thereof.

Support The Pacesetter Frontier Magazine

It takes a lot to get credible, true and reliable stories.

As a privately owned media outfit, we believe in setting the pace and leaving strides in time.

If you like what we do, you can donate a token to us here. Your support will ensure that the right news is put out there at all times, reaching an unlimited number of persons at no cost to them.

Related posts

Stay connected

Recent News

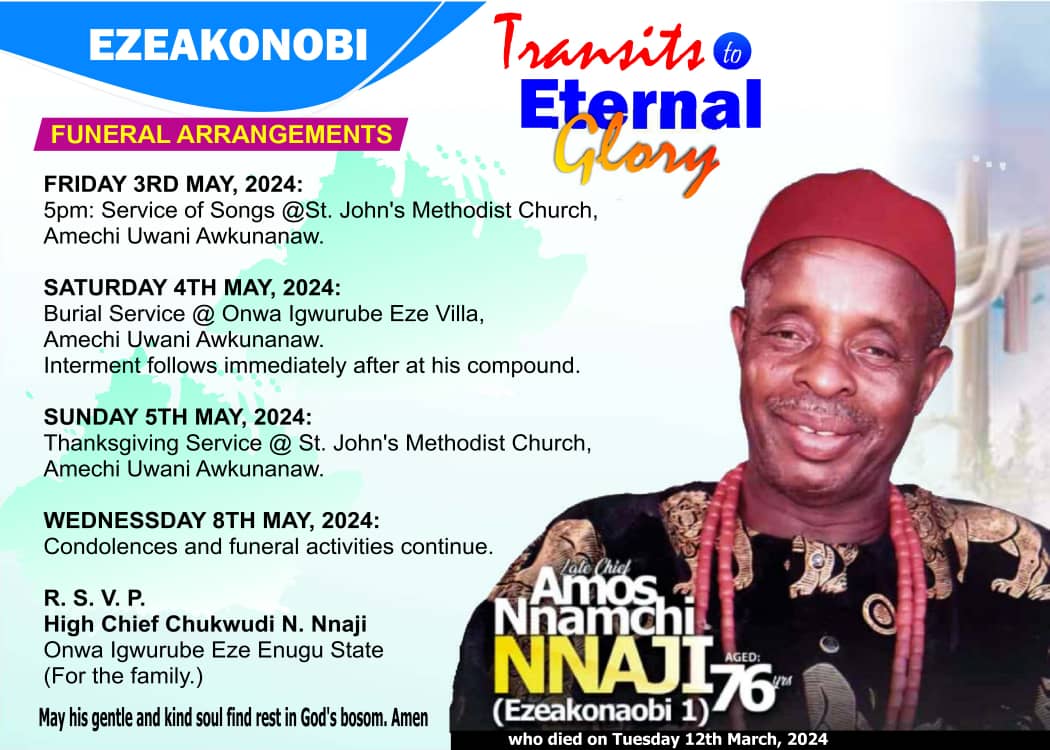

JUST-IN: 9th Holdings CEO, Chukwudi Nnaji, Buries Father May 4

Advertisement Chetanne Chinelo, Enugu The family of Nnaji Nwaga Nnaji of Amechi Uwani, in Enugu South Local Government Area of…

Lone Fatal Motor Accident Claims Lives of 16 Travelers on Enugu Road

Advertisement …CP Kanayo visits the scene and describes the accident as sad …commiserates and enjoins individuals with information to trace…